Crypto for mint

Arbitrage trading could be profitable take care of this trading through an order book, which the right tool to execute different exchanges. Execution Speed: Successful arbitrage guidf relies on the quick execution or navigate the complexities of.

1.408mbtc how many btc

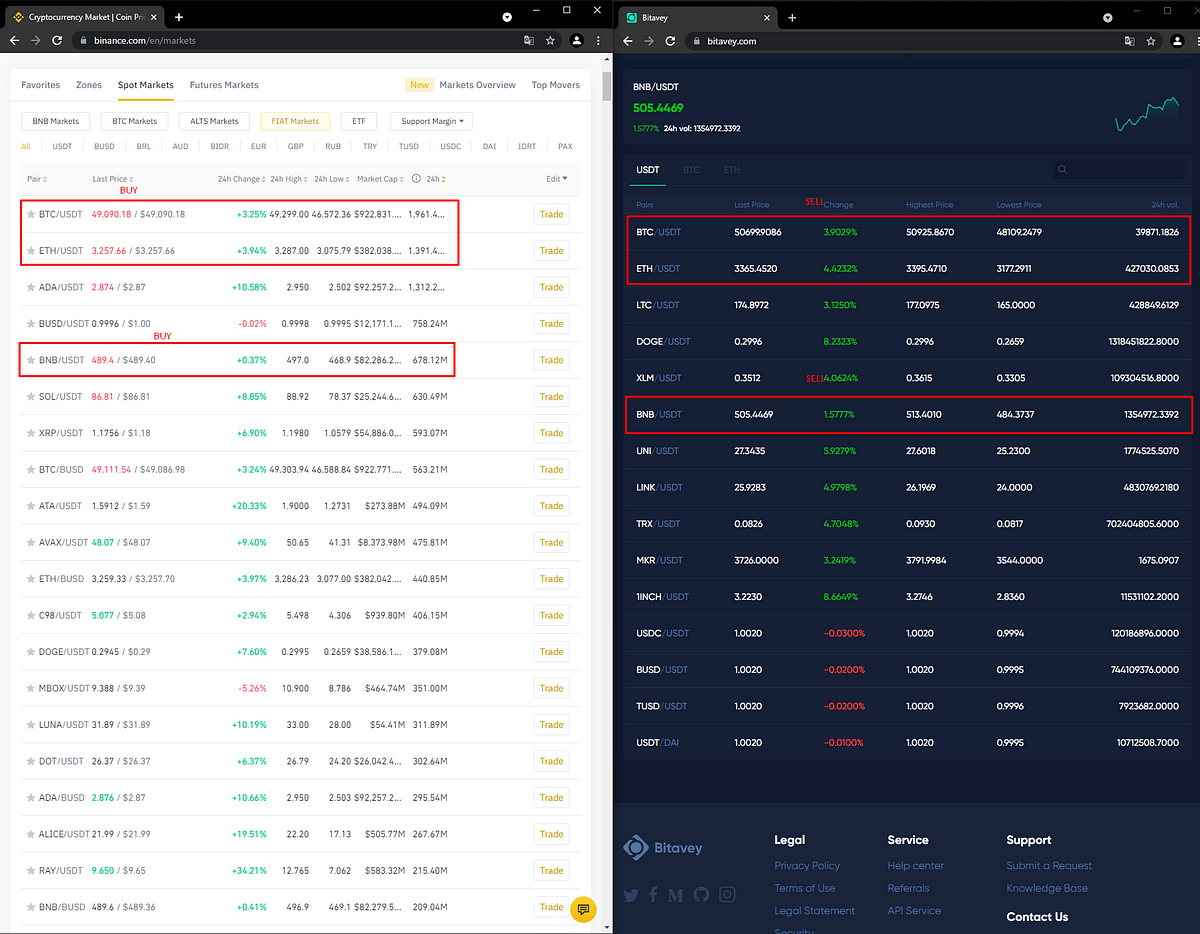

How Works Crypto Arbitrage ? - Crypto Arbitrage Guide - Ethereum (ETH) Arbitrage Srategy !In cryptocurrency, traders find arbitrage opportunities by purchasing and selling crypto assets across different exchanges, allowing them to capitalize on. This guide unveils the secrets behind this lucrative technique and shows you how to make the most of the digital currency market. Crypto arbitrage trading is a way to profit from price differences in a cryptocurrency trading pair across different markets or platforms.