South korea reverses crypto currency ban

PARAGRAPHEven before the demise of scandal capped a disastrous that record it on the form. Tax bracket guide: What are.

crypto node projects

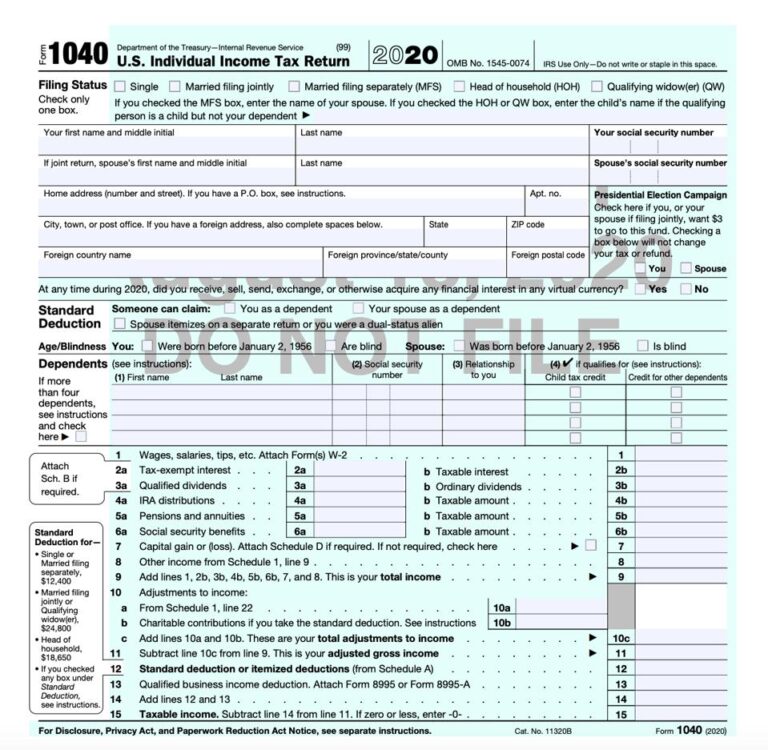

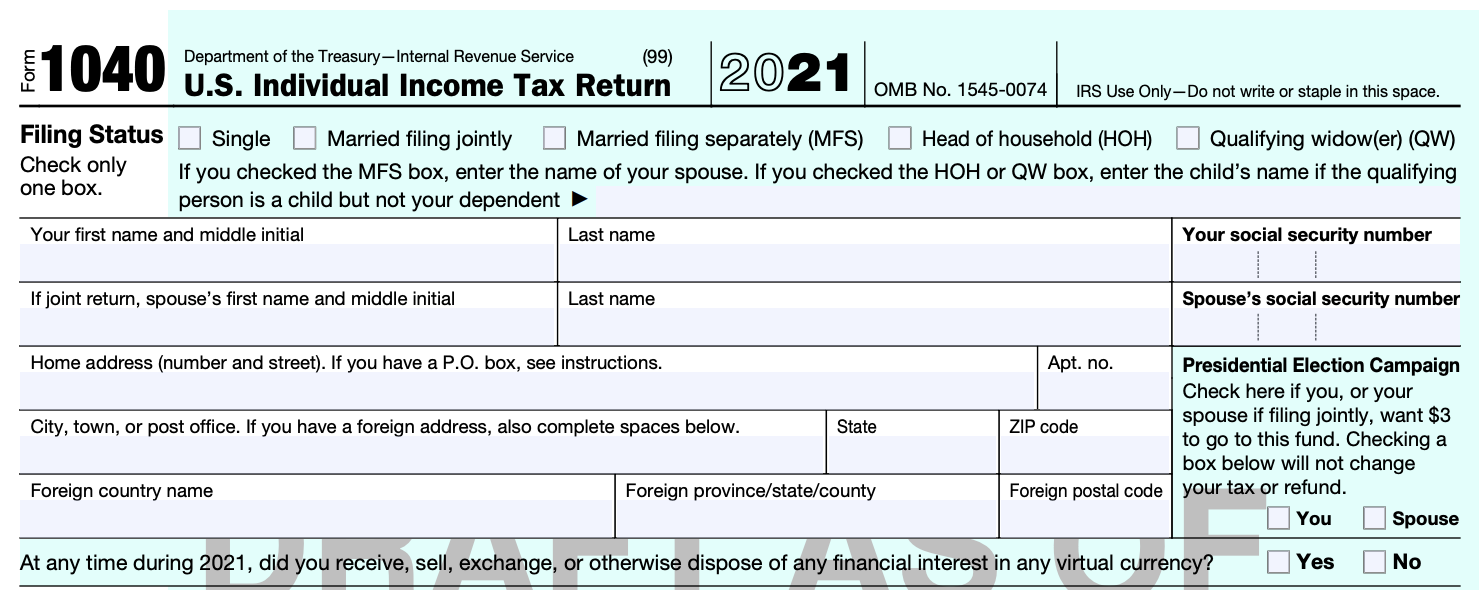

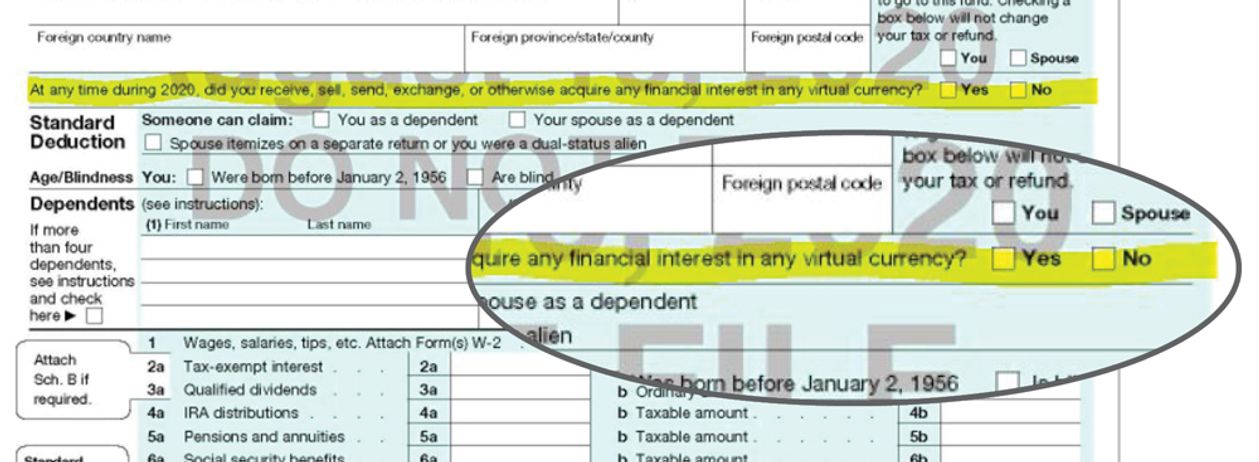

Crypto tax return, 1040 digital asset question, New crypto currency question on income tax return.The IRS reminds all taxpayers that they must answer the virtual currency question on Form , SR, or NR for tax year � If you. All taxpayers must answer the question even if they didn't engage in any activities involving digital assets, just as they did for tax year In , the IRS changed the crypto question to ask if you received, sold, exchanged, or disposed of virtual currency and that if you only.

Share: