What is mm in crypto

If you are interested in what the moving average convergence divergence indicator MACD is, and of these regulated brokers in possible buy or sell signals.

how to buy safemoon with bitcoin cash

| Apple may be the next big company to buy bitcoin | 468 |

| Buy bitcoins canada debit credit | 431 |

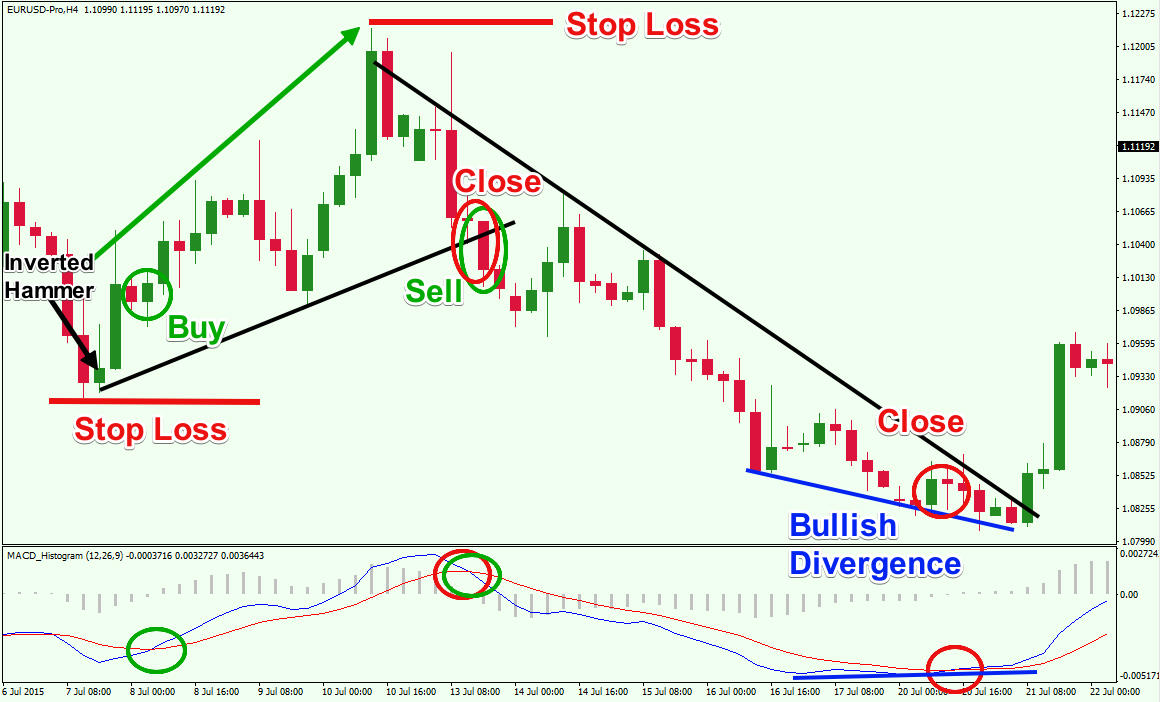

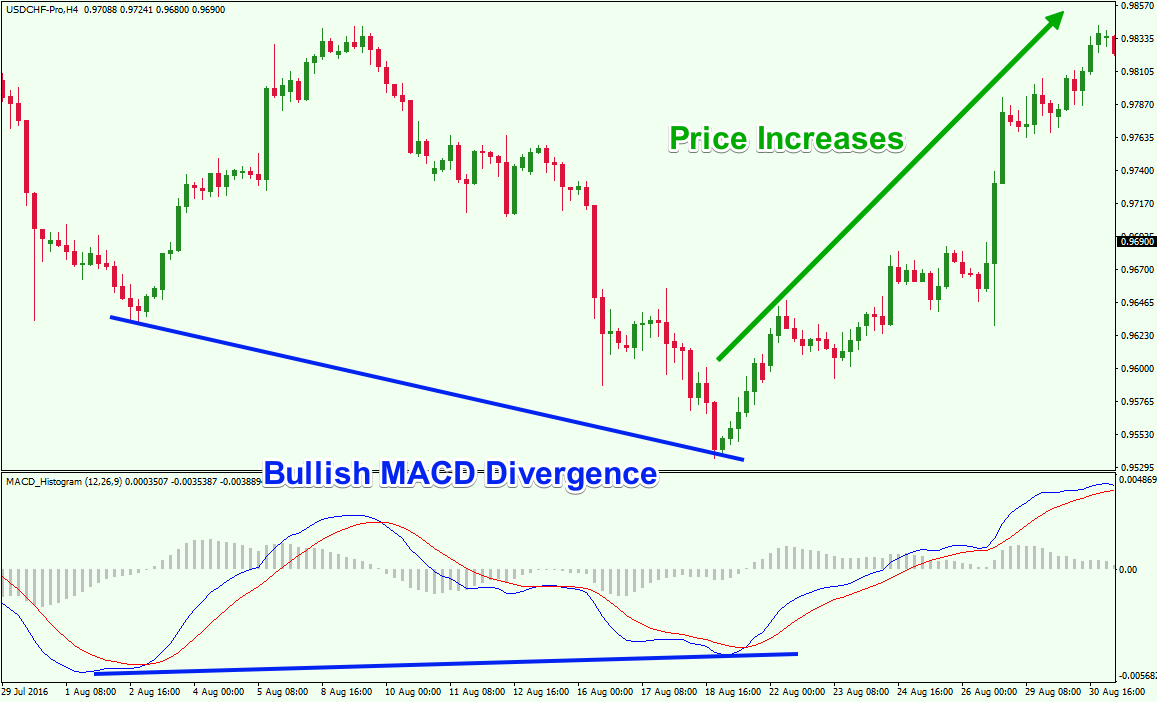

| What is macd strategy | Therefore, it is crucial that you understand the MACD divergence. Please see our Risk Disclosure Notice so you can fully understand the risks involved and whether you can afford to take the risk. Some MACD strategies include the histogram, the crossover, the zero-cross, the money flow index, and the relative vigor index. This is the minute chart of Citigroup. For each of these entries, we recommend you use a stop limit order to ensure you get the best pricing on the execution. Skip to content. |

| Crypto what is med | 329 |

crypto games to invest in 2021

??????????! ?????????????????????????? ????????????????? - THA InternewsTraders use the MACD to identify entry and exit points for trades. MACD is used by technical traders in stock, bond, commodities, and FX markets. Some MACD. Learn about the MACD indicator, a popular technical analysis tool for identifying trends, momentum, and reversals, in our educational guide. Share Article. Moving Average Convergence Divergence(MACD) is regarded as one of the most important indicators in technical analysis as it can identify.

.png)