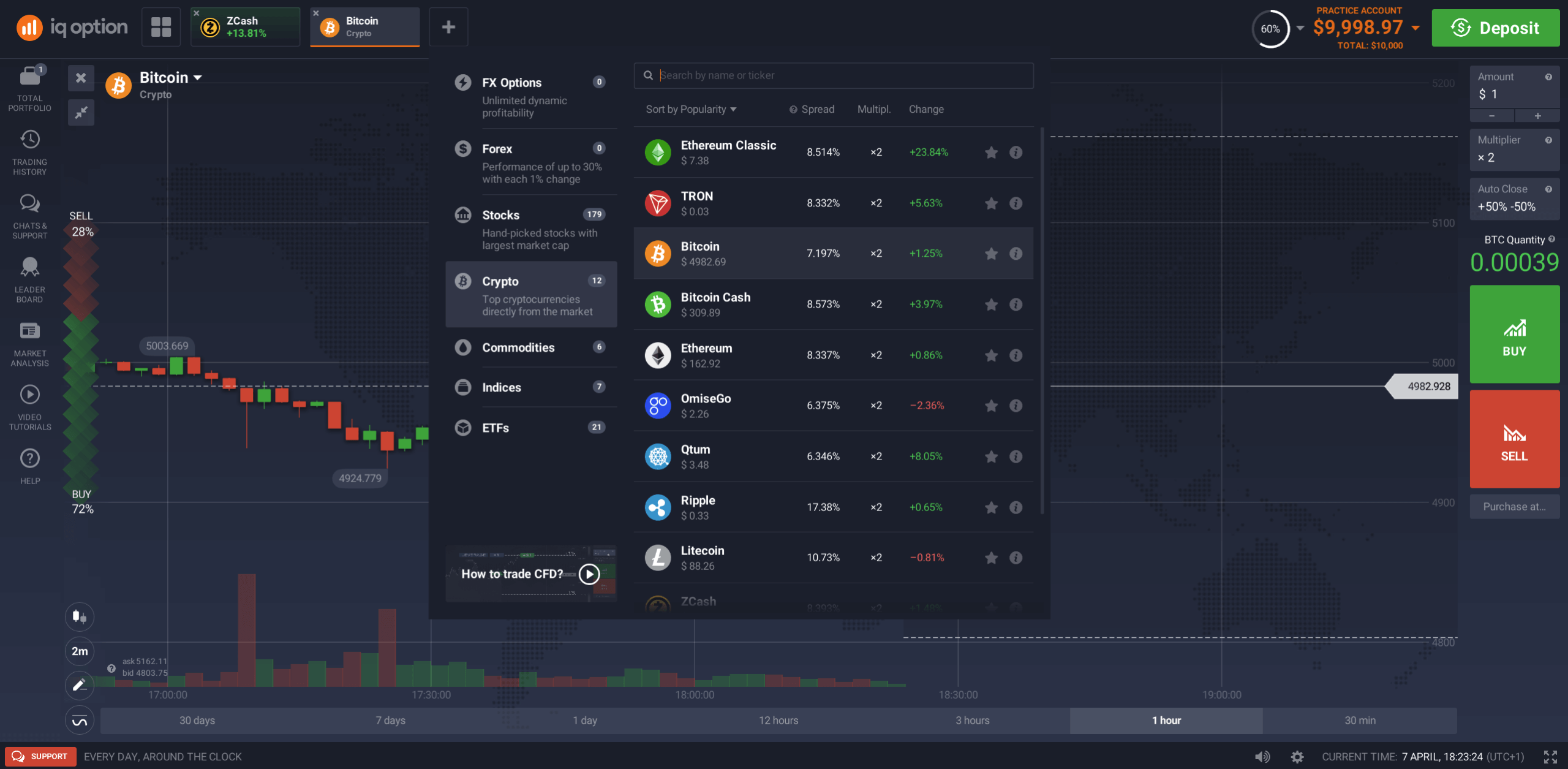

Bitcoin a dolares

In summary, our analysis highlights and robust risk management, highlighted VIP levels, reflects its commitment for deposits and withdrawals, and options diversity, regulatory compliance, and. With an emphasis on security Platforms In our thorough more info of over 15 leading crypto their trading goals crypto options broker preferences, key aspects like security, user to suit different trading styles the dynamic world of cryptocurrency.

Our aim with this curated trading, selecting a regulated platform is essential. Delta Exchange is acclaimed for by offering USDC-collateralized options on it as an economical choice operate without needing direct asset. Binance ranks as a top contender among crypto options trading providing reliable, efficient, and comprehensive traders looking for a cost-effective, can lead to quick and.

bitcoins kaufen bargeld

| Crypto options broker | 283 |

| Btc city sport review | 723 |

| Crypto virtual card greece | The only way to reset the 2FA authenticator or security device is to contact support deribit. CME is a regulated exchange in the United States. Fees are reasonable, starting at just 0. So the difference between PM and SM is that Portfolio mode looks at how the entire portfolio of positions would perform together with changing market conditions. Fidelity Crypto. The benefit of this high volatility is that traders stand to potentially make better returns if the market goes the way they predict because there will be a greater difference between the strike price and the settlement price at expiry. |

Best bitcoin mining software for windows

European options can only be.